Welcome to MakeCareer

Welcome to MakeCareer

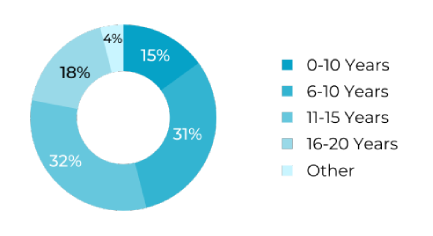

Postgraduate certification in the practical application of banking, finance, and accounting.

Apprehend the complexities of the financial landscape to foster expansion and navigate through digital changes

Welcome to MakeCareer

Welcome to MakeCareer

Certificate in Applied Banking, Finance, and Accounting at the postgraduate level.

Comprehend the intricacies of the financial terrain to facilitate growth and navigate digital transformations.